Bank of Israel Conference on Financial Education in Arab Society

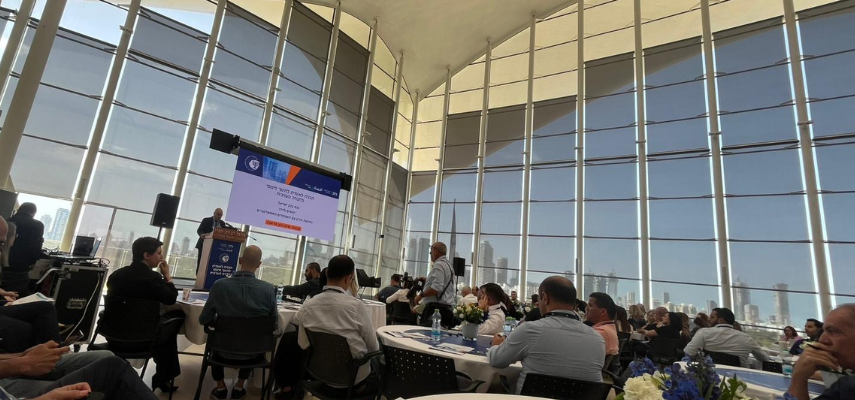

On May 13th, the Bank of Israel held its second annual conference on financial education in Arab society at Yitzhak Rabin Center in Tel Aviv, presenting a strategic plan for advancing the national initiative. Launched in 2023, the program is led by the Bank of Israel with support from key partners, including the Office of the President and several government ministries, overseeing broader efforts to advance financial inclusion of Arab citizens.

In recent years, financial inclusion has become a key focus for improving the socio-economic status of Arab citizens in Israel. High poverty and unemployment rates, coupled with limited access to banking, loans, and credit, create barriers that often drive people toward the gray market and increase their risk of financial exploitation. In this context, financial literacy stands out as a practical area for intervention.

The conference brought together key stakeholders in financial education and Arab society, including regulators, government officials, academics, municipal leaders, and representatives from the business and nonprofit sectors. Among the speakers were CPA Naim Najjar, member of the Bank of Israel’s Board of Directors; Hassan Towfra, Director General of the Authority for Economic Development of Arab Society; Shirin Nator-Hafi, Head of the Arab Education Department at the Ministry of Education; Nurit Pelter Eitan, Director of Communications, Public Relations, and Community Affairs at the Bank of Israel; and Vered Yefet, Director of the Community Relations and Financial Education Unit at the Bank of Israel.

At the opening of the conference, greetings were delivered by the President Isaac Herzog and Bank of Israel Governor Prof. Amir Yaron. Opening remarks emphasized the importance of financial literacy in Arab society, which currently has the lowest financial education levels nationally. Government experts noted that the program promotes informed financial decision-making, supports economic growth, and helps reduce poverty.

Bank of Israel Study on Financial Literacy in Arab Society

At the convening, Nurit Pelter Eitan, Head of Communications at the Bank of Israel, presented findings from an October 2024 study led by Dr. Haran Rozen Maya, outlining a vision for significantly expanding financial literacy in Arab society. Based on the strategic principles shared, a five-year action plan is now being developed in collaboration with program partners.

Study Recommendations

The report’s main recommendation is to implement a multi-year national financial education program in Israel, with a particular focus on the Arab community. Additional recommendations include:

- Establishing a subcommittee to promote financial awareness.

- Placing special emphasis on banking services and payment methods.

- Creating a culturally and linguistically adapted financial education portal for the Arab community.

- Integrating financial education into the Arab schools curriculum.

The report confirmed that financial education improves financial literacy, promotes informed decision-making, builds trust and financial inclusion, and strengthens economic resilience and overall well-being. The report emphasizes the program’s national importance, highlighting its potential to strengthen Israel’s economy and society by reducing disparities, promoting financial stability, and combating black-market activity and crime.

Current Financial Literacy Status in the Arab Community

Several findings were presented on financial literacy levels among Arab citizens:

- Inflation Awareness: Over half of the Arab population did not understand inflation’s impact on purchasing power, compared to about 30% of the general population and OECD countries.

- Interest Rate Calculations: About half of the Arab population could not calculate compound interest, compared to only a quarter of the general population.

- Risk Diversification: Only 28% of the Arab population demonstrated an understanding of risk diversification compared to 48% of the general population, falling below OECD standards.

- Debt Management: Only one-third of the Arab population reported avoiding overdrafts in the past five years, compared to 57% of the general population.

- Savings: Only a third had saved independently in the past five years, a significantly lower rate than the general population.

- Loan Consultation: Fewer Arab citizens consulted financial professionals before taking loans or mortgages compared to half of the general population.

- Financial Confidence: Only about 20% felt confident in financial matters, a lower rate than the general population.

- Interest in Financial Guidance: Only 24% expressed interest in financial education related to savings before investing their monthly income, a lower rate than the general population.

Strategic Plan for Financial Education

During the convening, Adham Darawshi, the financial education project manager for Arab society, presented a detailed program that categorizes the target population into six main groups based on research findings:

- Children and Youth: Including elementary, middle, and high school students.

- Young Adults: Unemployed youth, university students, and young individuals within the Arab community.

- Young Families: Couples and young families navigating critical financial stages such as taking out mortgages and family expansion.

- Self-Employed Individuals: Small and medium business owners, most of whom are Arab entrepreneurs with low financial literacy.

- Senior Citizens

The plan also includes broader initiatives for the entire population, aligned with key life events, as well as targeted efforts for special populations such as women, Druze, Bedouin, and other distinct subgroups.

Initiatives will be tailored to districts and municipalities, reflecting local demographics and culture. Implementation will prioritize areas based on accessibility, urgency, literacy gaps, population size, program availability, potential impact, and workforce transformation prospects.

Ongoing pilots include:

- Financial education through simulation games.

- An Arabic-language financial education portal.

- Personal financial coaching for individuals in debt, led by economic advisors.

- Raising awareness for smart consumerism on social media.

As an educational initiative, the Ministry of Education is a key partner. Ms. Ferial Asaad, national financial education instructor, highlighted how the program meets Arab education needs by integrating financial literacy and supporting Arabic speakers in learning Hebrew, the language of most financial services. She also presented a pilot simulation game and specialized teacher training.

Roundtable Discussions

The conference’s final session featured roundtable discussions on key topics like youth, banking, and students. Participants shared field insights, discussed action plans, and explored potential partnerships.

How Can We Help?

Do you need support integrating these resources and issues into your philanthropic, communal, or Israel education work? Reach out for consultations, connections to experts, program support, training, or to plan your next event or mission. If you’ve used our resources, tell us about your experience!